About us

-

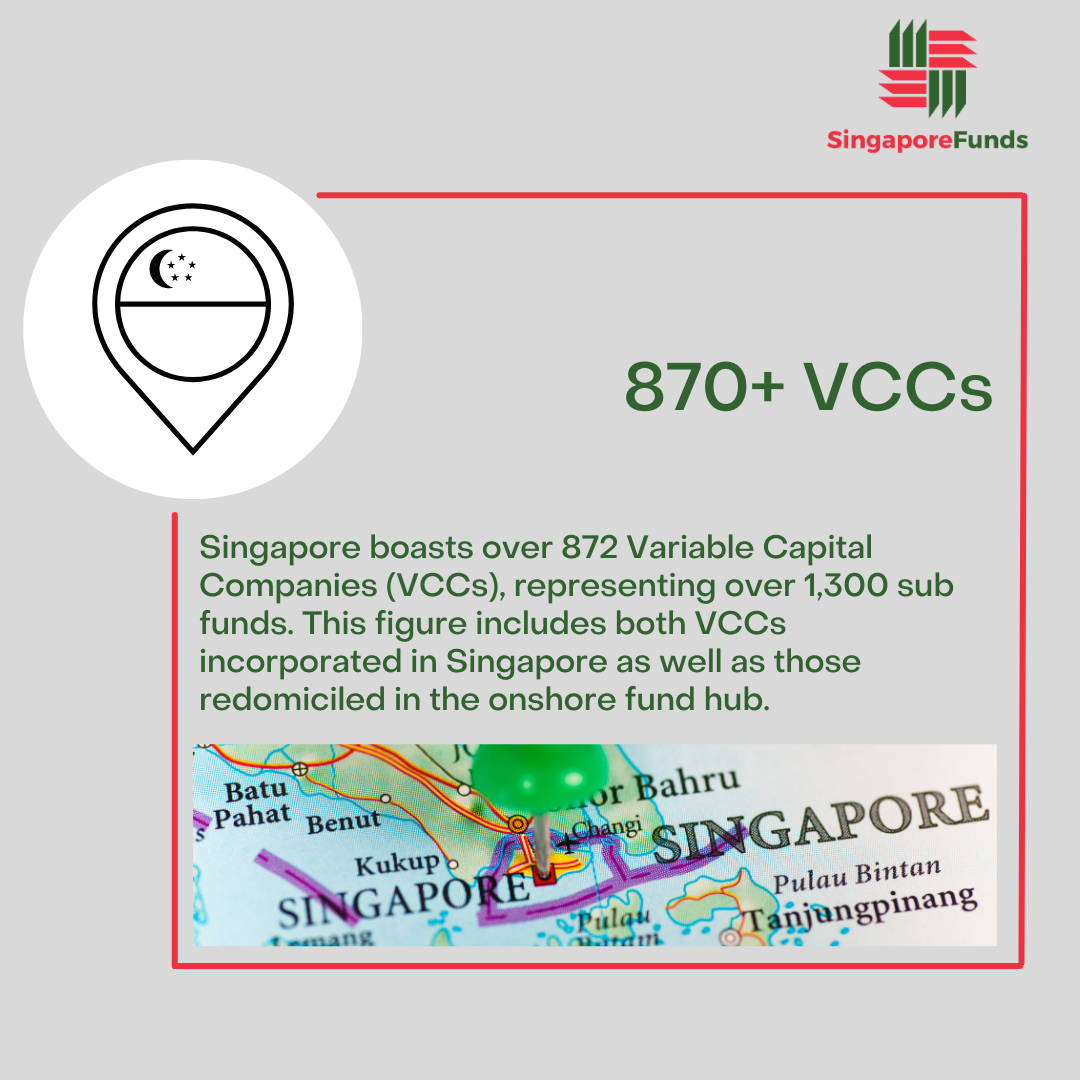

To enhance Singapore’s value proposition as an asset management and funds domiciliation hub, MAS is partnering with industry stakeholders within the funds ecosystem to establish the Singapore Funds Industry Group (“SFIG”).

SFIG brings together all the key players across the entire asset management value chain, including not just fund managers but also service providers such as lawyers, tax advisors, fund administrators and directors. SFIG will identify emerging industry trends and formulate strategies to develop the asset management ecosystem.

SFIG has been established with the following objectives:

- Lead the development and sustainable growth of Singapore’s asset management industry;

- Enhance the value proposition of the Singapore asset management industry by identifying industry trends, new market opportunities and recommending appropriate standards, developmental initiatives and innovative solutions for use in the industry;

- Formulate and review proposals that industry and policy makers can adopt, and implement proposed recommendations;

- Serve as an effective channel of communication between the asset management industry and the MAS and other government stakeholders;

- Build capacity and capabilities to support the growth of Singapore’s asset management industry; and

- Promote Singapore as a full-service international fund domicile hub.

-

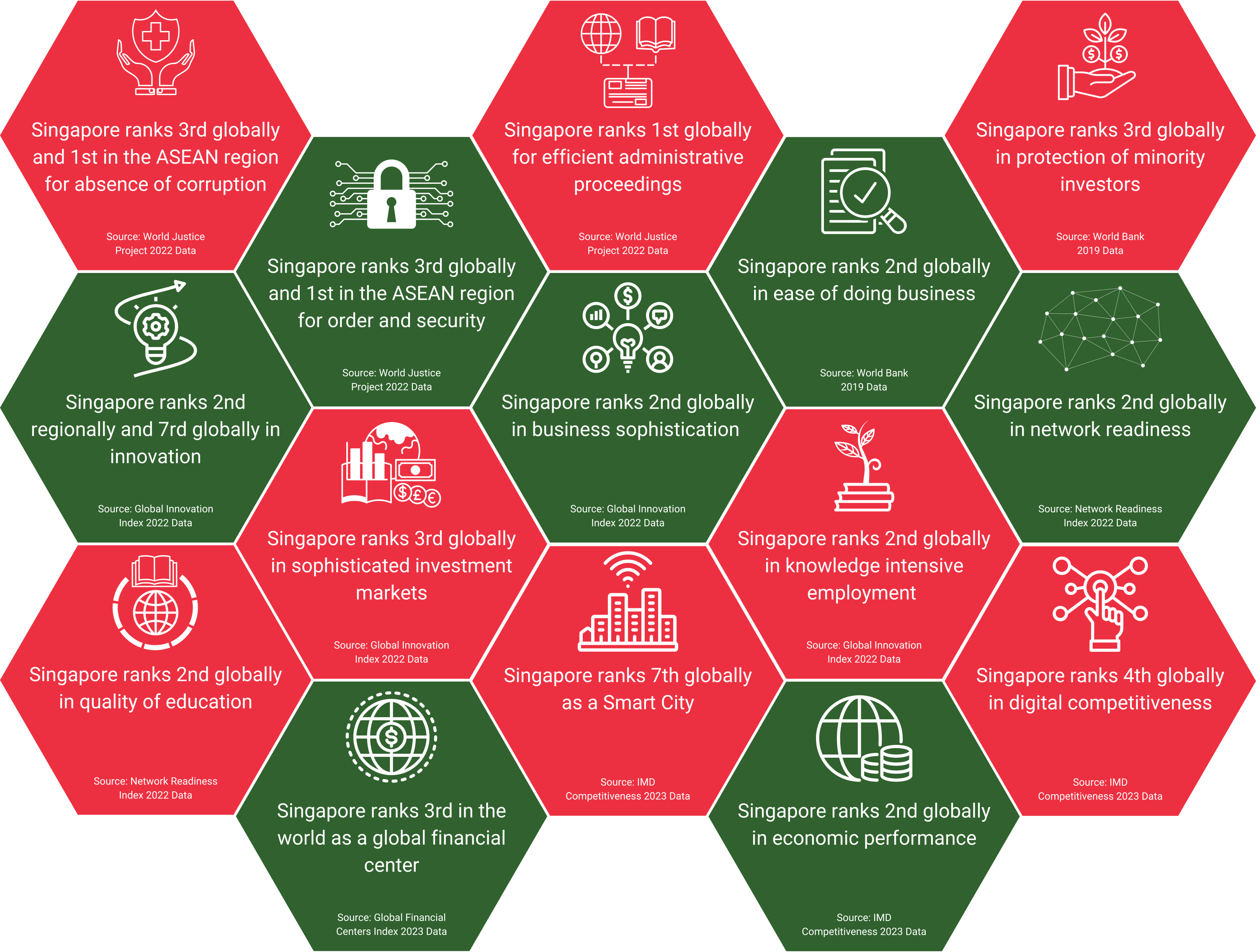

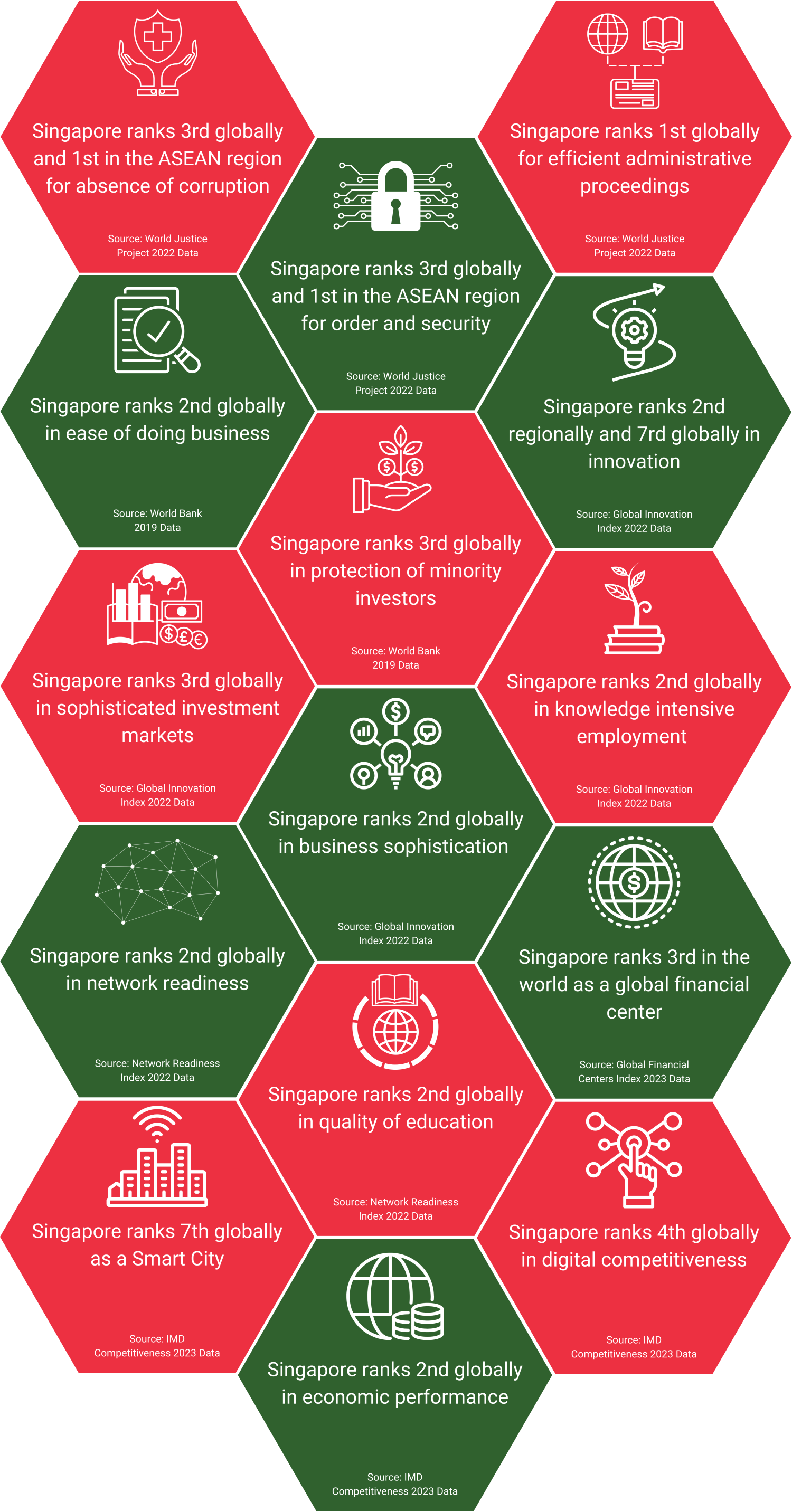

Source: World Justice Project Rule, World Bank, Global Innovation Index 2019, Network Readiness Index 2019

- The Monetary Authority of Singapore (MAS) is Singapore’s central bank and integrated financial regulator. MAS also works with the financial industry to develop Singapore as a dynamic international financial centre

- Asian pioneer in sandbox, Fintech and other regulatory measures to support the industry

- One of the world’s most business-friendly regulatory environment for entrepreneurs

- No foreign exchange control, removes the need to hedge currency for regulatory purposes

- Political and economic stability

- Thriving local VC scene; Asian PE’s and Asian Real Estate Fund’s locale of choice

- Focus on innovation, capital-intensive activities and a globalised workforce

- Very robust and well-coordinated inter government agency policies and procedures

- Asia’s only AAA credit rating from all 3 agencies - Singapore was given a top AAA credit rating from S&P, Fitch and Moody’s

- Well positioned to serve rapid growth of Asian finance – infrastructure funding, structured trade finance and wealth management

- Singapore’s strategic location at the heart of South East Asia provides a gateway for managers to domicile their APAC and ASEAN-focused funds here

- Well established financial services ecosystem supporting the asset management and funds industry

- Global aviation and shipping hub serving as a gateway to ASEAN, Oceania, Indo-Pacific and China

- MAS offers tax incentives for financial institutions setting up or expanding in Singapore

- Extensive DTA network - the most extensive network of free trade agreements (FTAs) in Asia

- Significant government incentives drawing entrepreneurs from around the region and around the world

- OECD & full FATF member

- Highly skilled and cosmopolitan workforce

- Vast array of training and scholarship programmes such as SkillsFuture, TechSkills Accelerator to help people upgrade their skills or learn new ones offered by the government in tandem with industry partners and educational establishments

- Attractiveness of Singapore to foreign talent as a place of choice for work and Lifestyle

- Rigorous corporate governance framework and adherence to international accounting standards

- Signed 44 bilateral investment treaties, designed to help protect investments made by Singapore-based companies in other countries against non-commercial risks

- Strong rule of law, and robust intellectual property (IP) regime - currently rated the best place in Asia and 2nd in the world

-

-

Over the years, different industry associations and various stakeholders in the funds industry in Singapore have worked closely with the Monetary Authority of Singapore to develop the ecosystem. The formation of SFIG will strengthen this public-private collaboration for the asset management industry to come together to drive cross-sectoral initiatives and provide opportunities to allow:

- - Collaboration across industry sub-sectors towards common developmental goals

- - Cross fertilisation of ideas across funds value chain and workstreams

- - Bottom-up initiatives and co-ownership of project outcomes with industry

- - Scalability of industry-wide projects & stakeholders buy-in

MAS

https://www.mas.gov.sg/The Monetary Authority of Singapore (MAS) is the central bank of Singapore and integrated financial regulator. MAS also works with the financial industry to develop Singapore as a dynamic international financial centre. Their mission is to promote sustained non-inflationary economic growth, and a sound and progressive financial centre.

The industry associations represented in the Singapore Funds Industry Group include:

AIMA

https://www.aima.org/The Alternative Investment Management Association (“AIMA”) represents the global alternative investment industry. 2,000 corporate members are spread across 60+ countries with $2 trillion+ hedge fund and/or private credit assets of manager members. Founded in 1990, with the Singapore Chapter being established in 2006, its core objective is to provide leadership to the alternative investment industry and to be its pre-eminent voice globally.

IMAS

http://www.imas.org.sg/The Investment Management Association of Singapore (IMAS) was formed in 1997 and is a representative body of investment managers spearheading the development of the industry in Singapore. Its mission is to spearhead the development of the industry in Singapore by fostering high standards of professionalism amongst practitioners and creating public awareness of, and interest in the industry.

SVCA

https://www.svca.org.sg/The Singapore Venture Capital & Private Equity Association (SVCA) was formed in 1992 to promote the development of the venture capital (VC) and private equity (PE) industry. Its mission is to foster greater understanding of the importance of venture capital and private equity to the economy in support of entrepreneurship, innovation, and growth, and to represent the interests of ther members in the broader VC and PE community.

SFAA

https://sfaa.com.sg/Founded in 2007, the Singapore Fund Administrators Association (SFAA) was established with the mission of driving the growth and standard of fund administration in support of Singapore's development as a global asset management hub. The SFAA serves as a central platform for fund administrators to discuss and push forward industry issues as a collective voice.

SFDA

https://www.sfda.com.sg/Established in 2020, the Singapore Fund Directors Association (SFDA) was formed with the mission to be Singapore's premier body representing fund directors to foster long-term success through advocacy and standards-setting in corporate governance, and professional development for fund directors.

-

Co-Chairs

Assistant Managing Director, Development and International Group, MAS

Gillian Tan

Partner, Head of Funds and Investment Management Group, Clifford Chance Singapore

Kai-Niklas Schneider

Gillian Tan is the Assistant Managing Director of the Development and International Group, overseeing MAS’ strategies to develop Singapore as an international financial centre as well as MAS’ international relations and engagements. Prior to this appointment, Ms Tan was Executive Director of the Financial Markets Development Department, which aims to promote a vibrant financial market in Singapore, with a focus on developing the capital market, asset management and insurance sectors as well as green finance capabilities and solutions. From 2016-2019, she served as Executive Director of the Enforcement Department, which is responsible for investigating and enforcing breaches under the laws administered by MAS, including anti-money laundering regulations and market misconduct offences.

Kai-Niklas Schneider is a Partner in the Singapore office and member of the APAC Private Funds Group of Clifford Chance. He is a US qualified lawyer with over 20 years of specialist experience in the funds sector and advises clients on the formation of and investment in a wide variety of private equity funds, real estate funds, infrastructure funds and credit funds. He also counsels clients on co-investments, secondaries and spin outs. As a member of Clifford Chance's global Executive Leadership Group, he leads the firm's focus on financial investors. Kai is a member of the Singapore Executive Committee of the Alternative Investment Management Association (AIMA) and is ranked Band 1 in Chambers Global and Legal 500.

Members

-

Chairman, Alternative Investment Management Association Singapore

Greg Laughlin

-

Deputy Chairman, Investment Management Association of Singapore

Eleanor Seet

-

Chairman, Singapore Venture Capital & Private Equity Association

Sunil Mishra

-

Chairman, Singapore Fund Administrators Association

Ashmita Chhabra

-

Chairman, Singapore Fund Directors Association

Martin O’Regan

Greg Laughlin is CEO of Regal Funds Management in Singapore. Four times awarded ‘Australian Alternatives Investment Manager of the Year’, Regal manages a diverse range of strategies covering long/short equities, private markets, real & natural assets, credit & royalties, from offices in Australia, Singapore, and Europe/UK. Prior to joining Regal, Greg worked in COO roles at long/short equity hedge funds and spent 12 years working in various management roles at Credit Suisse, including in risk management and structured financing in CS’s New York Prime Brokerage team. Greg started his career with Deloitte in tax and accounting for 4 years, and also worked for Macquarie Bank and Bankers Trust in product control roles.

Eleanor Seet is President and Head of Asia ex-Japan for Amova Asset Management Asia Limited. She is instrumental in driving Nikko AM’s growth in the region, with oversight of Singapore and Hong Kong, and joint venture relationships in China and Malaysia. Currently serving as vice-chairman on the Executive Committee of the Investment Management Association of Singapore (IMAS), chair of the Institute of Banking and Finance (IBF) Fund Management Workgroup and member of the Standards Committee, Eleanor is a founding member of the Bloomberg Women’s Buy-side Network and a mentor of the Financial Women’s Association of Singapore. She holds a Bachelor of Economics from the University of New South Wales, Sydney. In 2022 she was conferred the IBF Distinguished Fellow distinction.

Sunil specializes in fund selection, due diligence, negotiations, and monitoring of Asian investments ex-China, specifically in India, Australia, Japan, Southeast Asia, and Korea. He also actively participates in all fund investment decisions and is involved in the sourcing, screening, execution, monitoring, and exiting of growth and buyout co-investments. Sunil manages relationships with several of Adams Street’s managers and sits on advisory boards of more than a dozen private equity firms within the Adams Street Partners portfolio. He is currently Chairman of the Singapore Venture Capital and Private Equity Association (SVCA) and has been a member of the SVCA Board since 2016. He is also a member of Adams Street’s Environmental, Social, and Governance (ESG) Committee.

Ashmita has over two decades of experience working with global asset owners and managers in the APAC region. As Managing Director heading the governance and corporate administration practice of Mourant in Singapore, she specializes in governance matters related to investment funds and their investment holding companies. Her career included supporting asset managers on their fund establishment, service provider selection and market entry into the region. Prior, she oversaw business development, client relationship management and the expansion strategy at the Apex Group. She spent the first decade of her career with EurekaHedge and Mizuho Bank, building their global alternatives funds’ research business. Ashmita chairs the Singapore Fund Administrators Association and Co-Chairs the Promotion and Advocacy Working Group of SFIG.

Martin O’Regan is managing director of Solas Fiduciary Services, providing truly independent directorship service, based in, and privately owned in Asia. With over 20 years of experience in investments funds and other alternative investment vehicles, Martin has held senior roles for Deutsche, Citi, Apex and UBS at Bermuda, Dubai, Cayman Islands, Hong Kong, and Singapore. Martin is licensed as a director with the Cayman Islands Monetary Authority (CIMA). He is also Chairman of the Singapore Fund Directors Association (SFDA).

-

Partner, Financial Services Leader, Asset & Wealth Managed Services Leader, PwC Singapore

Justin Ong

-

Partner, Financial Services Tax Leader, APAC, Ernst & Young

Amy Ang

-

Founder and CEO, Gordian Capital Singapore

Mark Voumard

-

Partner, Tax, Co-Sector Head, Asset Management and Real Estate, KPMG in Singapore

Anulekha (Anu) Samant

-

Partner, Shook Lin & Bok LLP

Woon Hum Tan

Justin is the PwC Singapore Financial Services Leader and Asset & Wealth Managed Services Leader and has more than 32 years of experience working with asset managers in Singapore, London and Continental Europe advising Asian asset managers on market entry and fund distribution in Europe as well as European managers and asset servicers around opportunities in Asia. He has a Bachelor of Economics degree from Monash University, Australia and holds the Investment Management Certificate (IMRO Full Version) issued by the Institute of Investment Management and Research (UK). He is a Chartered Accountant of the Institute of Singapore Chartered Accountants and Certified Practising Accountant (CPA) of the Australian Society of Institute of Certified Practising Accountants.

Amy Ang is a tax partner based in Singapore, leading the EY Financial Services Tax Practice across Asia Pacific. In this role, she leads the delivery of EY tax services to clients in the financial services industry across Asia Pacific. Amy has more than 20 years of experience as a tax advisor, specialising in the Asset Management, Banking and Capital Markets, and Insurance. She works closely with clients, industry players and authorities, and regularly speaks to media and with industry bodies. She is known to provide pragmatic tax advice with a commercial lens and is actively consulted on tax changes impacting the Asia Pacific region and specifically on the impact on funds and financial institutions.

With over four decades of experience based in Asia, Mark is founder and CEO of Gordian Capital Singapore (est. 2005), Asia’s leading independent alternatives institutional platform and fund structuring specialist (AUM US$20bn) where he has structured and launched over 110 funds (hedge, private equity, venture capital, real estate, and private credit). Mark is registered with the MAS as a Registered Representative, ASIC and the US SEC, is a Member of the Australian Institute of Company Directors (AICD) and the International Bar Association (IBA). He represents Gordian Capital as a member of AIMA, SVCA, IMAS and AVPN. Holding both Australian and Swiss citizenship, he studied Economics and Japanese at Monash University and is a fluent Japanese speaker.

Anu is a Partner in the Firm’s corporate tax practice and is focused on the Asset Management sector. She has served a wide portfolio of clients, mostly multinationals. Anu is involved in advising fund managers on tax efficient structures for their fund vehicles focusing on various asset classes and various geographies. She is involved in the tax aspects of fund formation, and has worked with fund managers in structuring downstream investments in the Asia-Pacific region. Anu has over 23 years of tax experience working in Singapore, Switzerland and India, 17 years are attributed to Singapore. Anu is a member of the Advocacy Subcommittee of the Singapore Venture Capital & Private Equity Association.

Tan Woon Hum has been in private legal practice for about 30 years and is the Head of Trust, Asset & Wealth Management practice at Shook Lin & Bok LLP (which he spent about 25 years). He specialises in investment funds (both onshore and offshore funds), VCCs, REITs, trusts, and family offices, as well as licensing and regulatory matters. He is well versed with independent asset managers, multi-family offices and single-family offices. Woon Hum is ranked as a Band 1 leading investment funds lawyer by Chambers Asia-Pacific since 2014, Elite Practitioner by AsiaLaw Leading Lawyers in 2023 & 2024, and top 100 lawyer in Singapore by Asia Business Law Journal in 2023 & 2024.

-

Shareholder, Greenberg Traurig Singapore LLP

Jek Aun Long

-

CFA, CAIA, Managing Director, Head of Southeast Asia, Hamilton Lane

Kerrine Koh

Jek Aun Long has focused on funds and regulatory work since 1998. He works on private and public as well as listed funds, including private equity/venture capital, real estate/infrastructure, digital assets, private credit, hedge funds, mutual funds and ETFs. He advises on structuring, establishment, registration and marketing of onshore and offshore funds. He provides guidance on licensing, regulatory and securities laws issues, and counsels institutional investors in connection with their investments. Jek Aun has assisted many of the most prominent names in the global fund management industry establish their regulated operations in Singapore. He has launched private and public tokenized funds and worked with global asset managers tokenizing the Singapore VCC as part of the MAS’ Project Guardian.

Kerrine is the Country Head for Hamilton Lane in Singapore. She is also the head of Client Solutions Group in Southeast Asia. Kerrine has more than 20 years of experience in financial services and investment management industry. Kerrine was named to Private Equity International’s (PEI) top 60 list of Women of Influence in Private Markets in 2023. Prior to this, Kerrine was the Head of Alternatives Distribution for Southeast Asia and head of Institutional Client Business for Southeast Asia at BlackRock. Kerrine has an MSc degree in Applied Finance from Singapore Management University and a BA degree, with first class honours, in Economics from the National University of Singapore. Kerrine is also a CFA and CAIA charter holder.

-

Chairman, Alternative Investment Management Association Singapore

Greg Laughlin

-

Deputy Chairman, Investment Management Association of Singapore

Eleanor Seet

-

Chairman, Singapore Venture Capital & Private Equity Association

Sunil Mishra

-

Chairman, Singapore Fund Administrators Association

Ashmita Chhabra

-

Chairman, Singapore Fund Directors Association

Martin O’Regan

-

Partner, Financial Services Leader, Asset & Wealth Managed Services Leader, PwC Singapore

Justin Ong

-

Partner, Financial Services Tax Leader, APAC, Ernst & Young

Amy Ang

-

Founder and CEO, Gordian Capital Singapore

Mark Voumard

-

Partner, Tax, Co-Sector Head, Asset Management and Real Estate, KPMG in Singapore

Anulekha (Anu) Samant

-

Partner, Shook Lin & Bok LLP

Woon Hum Tan

-

Shareholder, Greenberg Traurig Singapore LLP

Jek Aun Long

-

CFA, CAIA, Managing Director, Head of Southeast Asia, Hamilton Lane

Kerrine Koh

-

-

-

Promotion & Advocacy Working Group

Objectives

- Promote and advocate to raise awareness of the value of Singapore as both a global asset management center and as a global fund domiciliation hub by building and operating a website that offers all relevant information to asset owners, managers and service providers, both those established in Singapore and those planning to establish a presence.

- Effective dissemination of relevant documentation from within the Singapore Funds Industry Group (“SFIG”) and its membership, externally to academic, governmental or other bodies as well as asset owners and market participants capable of influencing the continued viability of Singapore.

- Multi-year marketing, media plan and initiatives to advocate for SFIG globally, and work towards influencing decision makers as well as those considering Singapore as an option.

Co-Chairs

Mark Voumard Ashmita Chhabra

Ashmita Chhabra

-

Policy Working Group

Objectives

- Assist in formulation of pragmatic policies to promote growth of the funds industry, principally focusing on regulatory & tax aspects to complement initiatives critical to the continued expansion of the Singapore fund industry.

- Work with industry to provide feedback on enhancements to current policy with regular reviews of the Singapore funds regime to ensure it remains relevant and progressive.

- Provide industry viewpoints on new legislation and initiatives in order to enhance their relevance and effectiveness.

Co-Chairs

Tax

Amy Ang Anulekha (Anu) Samant

Anulekha (Anu) Samant

Legal

Woon Hum Tan Jek Aun Long

Jek Aun Long